Imagine a world where growing your wealth doesn't require poring over stock charts or deciphering complex financial jargon. A place where consistent, small actions can steadily build a substantial financial future. This isn't a fantasy; it's the promise of platforms like Acorns, which simplify Investment Performance and Strategies with Acorns for everyday people. If you've ever felt intimidated by investing, or wondered how to get started without a huge sum, you're in the right place. We're going to break down how Acorns works, how it aims for steady growth, and the smart strategies you can employ to make the most of your money.

At a Glance: Acorns for Smart Investors

- Automated Investing: Acorns is a robo-advisor that simplifies investing by automatically managing diversified portfolios.

- Diversification is Key: Your money is invested across a variety of Exchange-Traded Funds (ETFs) to spread risk and capture market growth.

- Small Steps, Big Impact: Use features like "Round-Ups®" and recurring investments to grow your money consistently over time, leveraging compound growth.

- Personalized Portfolios: Your investments are tailored to your risk tolerance, financial goals, and timeline.

- Transparent Security: Your accounts are insured by SIPC (for investments) and FDIC (for checking), offering peace of mind.

- Understand the Fees: While convenient, Acorns' flat monthly fees can be a higher percentage for small balances compared to some competitors.

Unpacking Acorns: Your Gateway to Simplified Investing

For many, the world of investing feels like an exclusive club, guarded by complex terminology and high barriers to entry. Acorns was built to change that narrative. It's a robo-advisory platform designed to be incredibly user-friendly, particularly for beginners. Think of it as your personal investment coach, but one that operates silently in the background, making smart, diversified investment decisions on your behalf.

At its core, Acorns aims to demystify investing. Instead of asking you to pick individual stocks, it guides you toward creating a diversified portfolio using Exchange-Traded Funds (ETFs). These aren't single company shares, but rather baskets of various assets like stocks, bonds, and commodities. This strategy is foundational to reducing risk while steadily building wealth over the long haul. Smart algorithms are the brains behind the operation, adjusting your investments based on crucial factors like your comfort level with risk, your specific financial goals, and your investment timeline. It’s all about empowering you to tap into the fundamentals of smart investing without needing a finance degree.

The Acorns Growth Engine: Core Strategies in Action

Acorns isn't just about putting your money somewhere; it's about employing proven investment strategies, often without you even realizing it. These strategies are designed to work together, fostering consistent growth even from small contributions.

1. Diversification: Spreading Your Wings with ETFs

One of the oldest and most trusted principles in investing is diversification. The idea is simple: don't put all your eggs in one basket. Acorns champions this by building your portfolio exclusively from ETFs. These funds offer instant diversification by holding dozens, hundreds, or even thousands of underlying securities.

For instance, instead of buying shares of one tech company, an S&P 500 ETF (like Vanguard S&P 500 ETF, VOO, which Acorns uses) gives you a tiny slice of the 500 largest U.S. companies. This means if one company stumbles, your entire investment isn't derailed. Acorns utilizes nearly 25 different ETFs across its portfolios, covering various asset classes, geographies, and sectors to further enhance this spread. If you're curious about how these powerful tools work, you can take a deep dive into Exchange-Traded Funds to grasp their full potential.

2. Automation: Effortless Investing in the Background

Life is busy, and remembering to invest consistently can be a challenge. Acorns tackles this head-on with powerful automation features:

- Round-Ups®: This is arguably Acorns' most famous feature. It connects to your linked debit or credit cards and rounds up your everyday purchases to the nearest dollar. Once these spare changes accumulate to $5, they are automatically invested into your portfolio. Buying a coffee for $3.50? Acorns rounds it up to $4.00 and puts $0.50 towards your investments. It’s "found money" that you likely wouldn't miss, working hard for your future.

- Recurring Investments: Beyond Round-Ups, you can set up regular, automatic deposits from your bank account. Whether it's $5 a day, $20 a week, or $100 a month, consistent contributions are a cornerstone of long-term wealth building. This disciplined approach removes the emotion from investing and ensures you're always putting money to work.

3. Personalized Portfolios: Tailored to Your Comfort

No two investors are alike. Your financial goals, the time horizon you have to invest, and your comfort level with market fluctuations are unique. Acorns recognizes this by offering personalized portfolios. When you first sign up, you'll answer a series of questions designed to assess your:

- Risk Tolerance: Are you comfortable with more ups and downs for potentially higher returns, or do you prefer a smoother, more conservative ride?

- Financial Goals: Are you saving for a down payment in five years, or retirement in 30?

- Investment Timeline: The longer your money has to grow, the more risk you can typically afford to take.

Based on your answers, Acorns' algorithms recommend one of several diversified portfolios, ranging from "Conservative" (heavily weighted towards bonds) to "Aggressive" (primarily stocks). These portfolios are built to align with your personal financial profile, aiming for the best possible outcome given your individual circumstances.

4. The Power of Compound Growth: Your Money Making More Money

All these strategies—diversification, automation, and consistent contributions—converge to harness the incredible power of compound interest. This is when the earnings from your investments start earning their own returns, creating a snowball effect. Small, consistent investments made over many years can accumulate into surprisingly large sums, precisely because of compounding. Acorns makes it easy to stick with this long-term approach, letting time and consistent effort do the heavy lifting.

Your Acorns Portfolio: A Closer Look at What's Inside

Understanding what your money is actually invested in can give you greater confidence and clarity. Acorns constructs its portfolios from a selection of nearly 25 carefully chosen ETFs. These aren't just random funds; they represent broad market segments designed for robust diversification.

For example, a common component in many Acorns portfolios is the Vanguard S&P 500 ETF (VOO), known for its extremely low expense ratio of around 0.03%. This means for every $1,000 you have invested in VOO, you pay just 30 cents a year in fees to the fund provider. Other ETFs might include those tracking international stocks, corporate bonds, government bonds, and real estate, depending on your risk profile.

Understanding Expense Ratios: The Cost of Diversification

Every ETF has an "expense ratio," which is an annual fee charged by the fund provider (not Acorns) to cover its operating costs. Acorns selects ETFs with generally low expense ratios, but it's important to be aware of them. For instance, while VOO is 0.03%, some more specialized funds, like certain socially responsible investing (SRI) ETFs, might have expense ratios closer to 0.15% or 0.25%. These fees are already baked into the fund's performance and are not an additional bill you receive.

Exploring Socially Responsible Investing (SRI) with Acorns

For those who want their investments to align with their values, Acorns offers a Socially Responsible Investing (SRI) portfolio option. This portfolio invests in ETFs that specifically target companies meeting certain environmental, social, and governance (ESG) criteria.

While admirable, it's crucial to examine the nuances. SRI funds often come with slightly higher expense ratios compared to their conventional counterparts. For example, the iShares ESG Aware MSCI USA (ESGU) ETF, which might be found in an SRI portfolio, has an expense ratio of around 0.15%—five times higher than VOO. Furthermore, the definition of "socially responsible" can be subjective, and some analyses have shown that even certain SRI funds may include companies whose practices might raise eyebrows. It prompts a thoughtful question: is paying higher fees for an SRI fund truly the most impactful approach, or might investing in a cheaper, broad-market ETF and personally donating the fee difference to a cause you care about be more effective? This is part of the ongoing discussion when navigating the world of SRI.

Your Journey Begins: Setting Up Your Acorns Account

Starting your investment journey with Acorns is designed to be straightforward and takes just a few minutes. Here's a step-by-step guide:

- Download the App: Find "Acorns" in your device's app store and install it.

- Create Your Account: Follow the prompts to set up your profile, including basic personal information.

- Assess Your Risk Tolerance: Acorns will ask you a series of questions about your financial goals, income, investment horizon, and comfort with market fluctuations. Be honest with your answers; this is crucial for tailoring your portfolio correctly.

- Choose Your Investment Plan: Acorns offers different subscription plans (e.g., Personal, Family) that determine which features and accounts you have access to (Invest, Later, Early, Debit).

- Link a Funding Method: Connect your primary checking account or debit card. This is how your Round-Ups and recurring investments will be funded.

- Begin Building Your Portfolio: Once linked, your Round-Ups will start accumulating, and you can set up your first recurring investment.

That's it! You're now on your way to building a diversified investment portfolio.

Monitoring Your Growth and Safeguarding Your Wealth

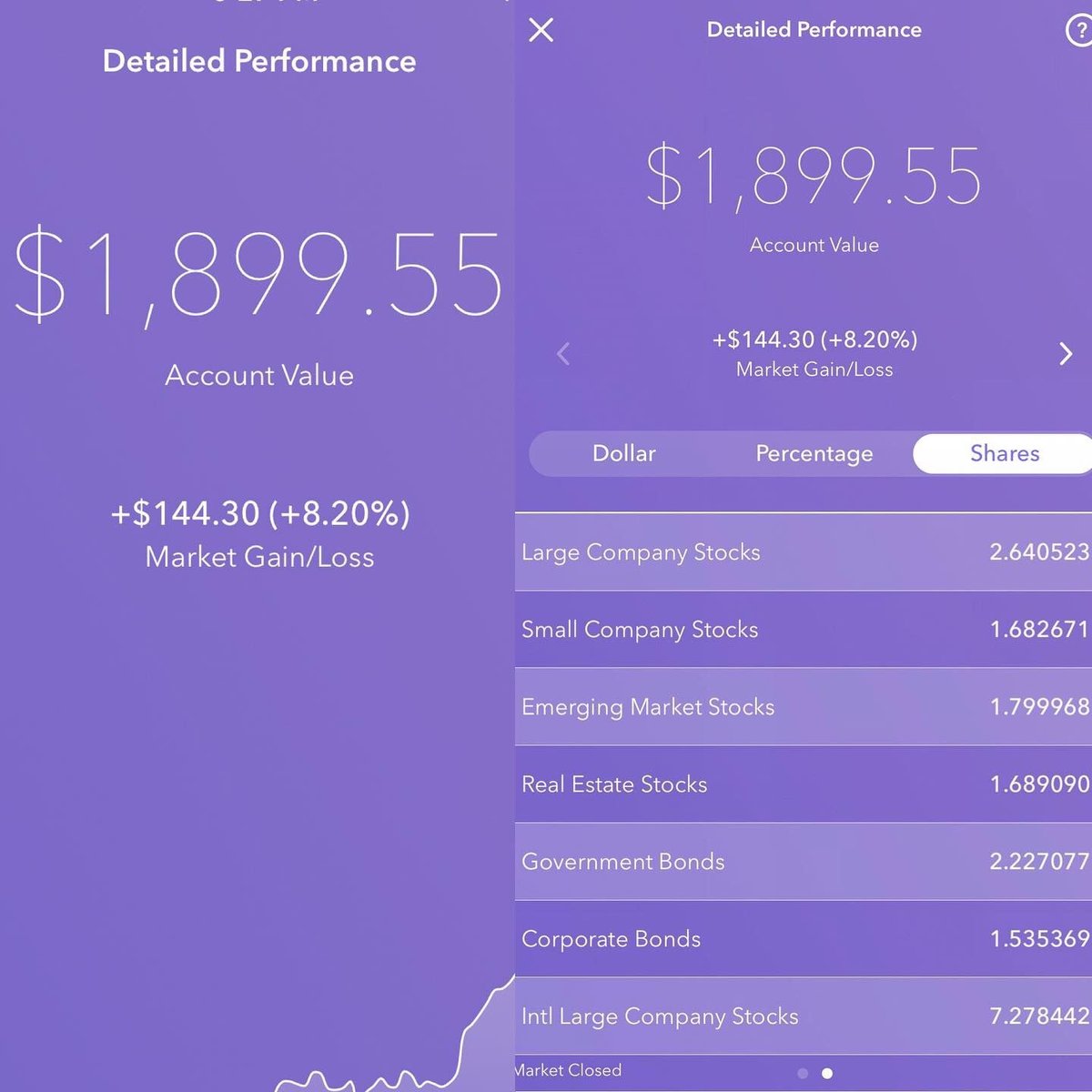

Once you're invested, staying informed about your portfolio's performance is simple. The Acorns app provides real-time tracking of your investment performance and growth. You can see your current balance, how much you've invested, and your overall returns. This transparency helps you stay engaged and motivated, watching your money work for you.

Rock-Solid Security Measures

It's natural to be concerned about the security of your money, especially when investing online. Acorns employs robust security measures to protect your personal and financial data:

- Strong Encryption: Your data is protected with 256-bit SSL encryption, the same level of security used by banks.

- SIPC Insurance: Your Acorns Invest, Later, and Early accounts are insured by the Securities Investor Protection Corporation (SIPC) for up to $500,000. This protects your investments in case Acorns fails, not against market losses.

- FDIC Insurance: If you opt for an Acorns checking account (via the Mighty Oak Debit Card), your funds are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000, just like a traditional bank account.

These layers of protection ensure that your assets are safeguarded, allowing you to invest with greater peace of mind.

Decoding the Acorns Fee Structure: A Candid Conversation

While Acorns offers immense convenience, especially for new investors, it's essential to understand its fee structure. Acorns charges a flat monthly fee, which varies depending on the plan you choose (e.g., $3, $5, or $9 per month for Personal, Personal Plus, and Premium plans, respectively).

This flat fee model has distinct implications, particularly for those starting with smaller balances. Let's look at an example:

- Acorns Flat Fee: If you have $100 invested with an Acorns Personal plan ($3/month), you'd pay $36 annually. This translates to a hefty 36% of your investment eaten up by fees in the first year alone!

- Percentage-Based Competitor: In contrast, many other robo-advisors charge a percentage of your assets under management, typically around 0.25% per year. For a $100 investment, this would be a mere $0.25 annually.

The takeaway: For very low balances, Acorns' flat monthly fee can be significantly more expensive in percentage terms compared to percentage-based fee structures. This high percentage fee can eat into your early returns, slowing your growth.

However, as your balance grows, the flat fee becomes a smaller proportion of your overall investment. For example, if you have $10,000 invested with Acorns Personal ($3/month), your $36 annual fee becomes just 0.36% of your balance, which is competitive with or only slightly higher than many percentage-based advisors.

When does Acorns become more cost-effective?

The "break-even" point where Acorns' flat fee becomes comparable to a 0.25% percentage fee would be around $14,400 ($36 annual fee / 0.0025 = $14,400). Above this amount, Acorns can be quite competitive, and for larger balances, it might even be cheaper than a percentage-based model.

It's crucial to factor these fees into your decision-making process. Understanding how Acorns stacks up against other robo-advisors is vital for making an informed choice that aligns with your current balance and future investment goals.

Beyond the Basics: Advanced Strategies for Acorns Users

Once you're comfortable with the core Acorns features, consider these strategies to further optimize your investment performance:

1. Maximize Your Round-Ups

Don't just rely on passive rounding. Look for opportunities to increase your transactional activity on linked cards to generate more Round-Ups. Even better, use the "Multiply" feature (available in some plans) to double or triple your Round-Ups. Every little bit truly adds up.

2. Supercharge Recurring Investments

While Round-Ups are great, they are often insufficient for serious wealth building. Prioritize setting up and consistently increasing your recurring investments. Even an extra $5 or $10 a week can make a significant difference over years, especially with the power of compounding. Treat your recurring investment like any other bill—a non-negotiable payment to your future self.

3. Leverage Acorns Later and Early Accounts

Acorns offers more than just taxable investment accounts:

- Acorns Later (IRA): This allows you to invest for retirement through a Roth or Traditional IRA. Contributing to an IRA offers significant tax advantages (either tax-free growth in a Roth or tax-deductible contributions in a Traditional). Making regular contributions to "Acorns Later" is one of the smartest long-term financial moves you can make.

- Acorns Early (UTMA/UGMA): This is a custodial investment account for children. It allows you to invest for your child's future, whether for college, a first car, or a head start in life. The assets are legally owned by the child, but managed by a custodian (usually the parent) until they reach adulthood.

Utilizing these specialized accounts can align your investments with specific life goals and optimize your tax strategy.

4. Revisit Your Risk Tolerance Periodically

Your financial situation, goals, and even your comfort level with risk can change over time. It's a good practice to revisit Acorns' risk assessment questions every few years, or after significant life events (like getting married, having children, or buying a home). Your portfolio should always reflect your current circumstances.

5. Take Advantage of Acorns Earns

Acorns Earns is a feature that partners with various brands to offer bonus investments back into your Acorns account when you shop with them. It’s essentially cashback directly into your investment portfolio. While it won't replace your core contributions, it's another passive way to inject extra funds into your growth engine.

Common Questions & Smart Answers About Acorns

Navigating investment platforms can bring up a lot of questions. Here are clear answers to some common queries about Acorns:

Is Acorns right for me?

Acorns is ideal for beginners, young investors, or anyone looking for a "set it and forget it" approach to investing. It's particularly strong if you struggle with consistent saving and benefit from automation like Round-Ups. However, if you have a significant sum to invest upfront and are very fee-conscious, or if you want complete control over individual stock selections, you might explore other options.

How safe is my money with Acorns?

Your money is very safe. Acorns uses bank-level security for data encryption, and your investment accounts are SIPC insured up to $500,000. Your checking accounts (via Mighty Oak Debit Card) are FDIC insured up to $250,000. This means that even if Acorns were to go out of business, your investments (up to the limits) are protected.

Can I lose money with Acorns?

Yes, investing always carries risk, and it's possible to lose money. Acorns invests your money in market-traded ETFs, and the value of these investments can fluctuate with market conditions. SIPC and FDIC insurance protect against the failure of the institution, not against market downturns. Acorns' diversified approach aims to mitigate this risk, but it does not eliminate it. The key is to invest for the long term, allowing your portfolio time to recover from any temporary dips.

How often should I check my Acorns portfolio?

While it's tempting to check your balance daily, especially when markets are volatile, a long-term strategy with Acorns encourages a less frequent approach. Checking once a month or once a quarter is typically sufficient. Obsessive checking can lead to emotional decisions, which are often detrimental to long-term investment performance. Trust the process and the power of consistent investing.

What are the minimum investment requirements?

Acorns has very low minimum investment requirements. You can start investing with as little as $5. This makes it incredibly accessible for almost anyone to begin their investment journey.

Making Acorns Work For You: A Long-Term Vision for Steady Growth

Ultimately, achieving steady investment performance with Acorns, or any platform, boils down to a few core principles: consistency, patience, and a long-term perspective. Acorns provides the tools to automate your contributions, diversify your holdings, and simplify the entire process, making it easier than ever to stick to these principles.

Don't underestimate the power of those small, consistent investments over time. The "spare change" from your Round-Ups, combined with regular deposits, can create a powerful wealth-building engine. By understanding the fee structure, leveraging all the account types, and periodically reviewing your strategy, you can harness Acorns to steadily grow your financial future. Your journey to smart, effortless investing starts now.